Chief Executive Officer

We all have a story – and our stories are unique.

Years ago, I was sitting at my conference table with the owners of a successful business. The conversation was around their assets and their family. At some point in conversations like this, the objective is to understand what it is the clients want. It is all about them. So, I asked this question: “let’s look down the road twenty years – what do you want your assets and your family to look like at that point?” They looked at each other. They looked out the window. They thought about it as I sat quietly until one of them said, “twenty years from now we just want our children to get together at Christmas and like each other.”

In short, their objective was to end well. They wanted everything to work. They started the business from scratch, and it was touch and go for many years and now it is very successful. Not ending well would be like playing a great game and then losing it right at the end. Creating discord within the family because of the way a lifetime of property is transferred is not a well-done ending. In fact, it is a heartbreak.

Even though our stories are unique, the stories of many of our clients have similarities. It is our job to listen and help. What we do or do not do when it comes to transferring wealth can have a lasting impact, possibly over generations. Sometimes the omissions and mistakes overshadow the good.

If I had to narrow down to three broad topics, I would go with relationships, money, and leadership.

I believe the older generations often underestimate their capacity to impact relationships. They have lived long enough to be forgiving of attitudes they themselves may have possessed years earlier that they now regret. They also understand that life is shorter than they once thought.

Elders can see the progression of the life stages of family members and the long-term evolution underway. When I was young and struggling there were some older men who spoke life and hope into me. The effort they made has been priceless.

Expressing love to someone who is angry and disrespectful requires humility, intentionality, and sometimes, courage. But it can be a game changer. Victor Frankel, who survived the Holocaust and later wrote Man’s Search for Meaning, said that love produces meaning and that even in the most hopeless situation, love offers hope.

Most are familiar with Abraham Maslow’s hierarchy of human needs. At the tippy top of the pyramid is selfactualization. One rarely gets to that point until they pass through the physical, safety, and belonging stages of life. So, it should not be a surprise that the different generations often respond differently to matters at hand. Maslow noted that in a way it is like moving from “becoming” to “being.” In my view, “being” refers to matters of the heart along with relationships and more.

Younger family members do not necessarily grasp the concept of how difficult it is to create wealth. Therefore, I believe telling and writing our family stories is important. As we go through life, we take hits and it is important to be transparent about our lessons learned. I believe eventually most people develop an interest in understanding where they came from and what their ancestors were like.

Stories told and written can be the glue that binds the individual members of the family together and be a catalyst for better understanding between the generations. I also believe stories like this are more carefully read once the author is gone. I believe many parents never get to see the results of their efforts to help their children see things that are important – the light comes on after the parents are gone.

Recently, I read biographies of the John D. Rockefeller family, as well as the Cornelius Vanderbilt family. They are vastly different stories. Mr. Vanderbilt’s obsession was with making money. He developed the nation’s first great industrial fortune and for a while was the richest man in the world. Relationships were not a priority and his story did not end well.

As a contrast, John D. Rockefeller understood the vision of each generation having issues unique to it and accumulating great wealth was never his goal. He retired at age 59. The Rockefeller family legacy is one of giving.

I recently saw a short video of a talk by Warren Buffett. Referencing the Holocaust, he alluded to relationships being more important than money. As a measure of relationships, he asked the listeners, “how many people do you have in your life who would hide you?” This question makes one pause to think.

In my experience, all progress starts by telling the truth. Things just go better when the older generation does all it can to deepen family relationships. This requires leadership.

Speaking of stories and communication, the last time parents communicate with their offspring is when the testamentary documents are called upon to transfer the property. This is the “final word” with their children and other descendants. These words may be read and contemplated over and over. It is best if the parents reasoning around the decisions are communicated, in person while they are alive.

Some of the decisions are difficult. Should assets remain within the bloodline? Should everything be split up equally or uniquely depending upon different needs that are present? Should an equal amount be left to each grandchild or an equal amount to each family unit? At what age should assets be available to children? What sort of structure is best all things considered?

What about making gifts to family while parents are living? What about philanthropy? Is it wise to hold onto and grow the assets and then leave everything all at once when the children may be in their 60s? Is it really a good idea to leave it to your heirs to sort through your personal property after you are gone and negotiate who gets what? Will estate transfer taxes impact plans?

During your lifetime, is there a basic level of lifestyle “watermark” that you want to help each of your children attain? What about help with education, health, and other necessities if needed – particularly if they face a hardship they are trying to overcome? Is it okay to help adult children do things they desperately need to do but cannot do for themselves?

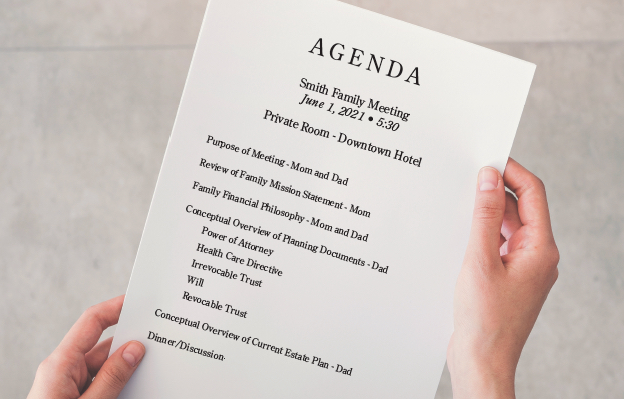

Important steps to take may be leading the family through a process of creating a family purpose statement. And, to aid communication and to shine a light on the inevitable, having periodic family meetings make a lot of sense. Creating a somewhat formal forum to express love, reasoning and plans is wise, in our view.

There are no right or wrong answers to much of this. Creating a picture of “it all working” after all is said and done and a plan requires effort. And the decisions needed highlight the necessity of involving an engaged financial advisory team that includes an estate planning attorney, CPA, wealth manager, and someone from our profession which is life insurance.